does betterment provide tax documents

Betterment provides automatic tax loss harvesting to all investors at no extra cost for Taxable accounts only. For individuals who have investments with the company they will receive Betterment tax forms during January or early February that will categorize their losses and gains.

The forms 1099-B reports your sales of stocks in 2021.

. The soonest you can start importing is Feb. SPbinder keeps workpapers in their original file type. Betterment LLCs internet-based advisory services are designed to assist clients in achieving discrete financial goals.

Betterment does provide Form 5498 to its members as long as they have made the IRA contributions made conversions as well as rollovers in their retirement accounts on the platform. The number is 149117. Betterment is a clear leader among robo-advisors offering two service options.

Betterment increases after-tax returns by a combination of tax-advantaged strategies. You can enter your form 1099-B by following. Betterment Digital provides automated portfolio management and charges 025 annually.

Betterment will send you. Betterment also offers tax-loss. Note that we do not currently support integration with.

We may also provide you with a Supplemental Tax Form that calculates key tax information for. Forms 1099-R and 1099-INT released. Just lump them together under a country.

Ad Used by over 23000 tax pros across the US from 3 of the Big 4 to sole practitioners. Betterment has calculated this for you based on your state of residence listed within your account. They are not intended to provide comprehensive tax advice.

With Betterment you can automatically import your tax information into TurboTax. 30 2020 Updated Dec. You will not receive a 1099-R for a direct trustee-to-trustee transfer from.

When importing tax forms you will be able to deselect certain tax. Ad Offer your employees a better 401k for a fraction of the cost of most providers. You have to enter them on your tax return.

The foreign taxes populate with the download but you have to manually enter the foreign source income total. On the other hand Betterments returns have been massive over 100 since the companys founding in 2004 so maybe they are onto something. Tax Filing Calendar.

If you have wash sales it gets more complicated since those adjusted transactions have to be itemized on Form 8949 and the summary totals adjusted accordingly. Ad Offer your employees a better 401k for a fraction of the cost of most providers. Betterment LLCs internet-based advisory services are designed to assist clients in achieving discrete financial goals.

The no-fee plan costs 0 in fees and requires 0 in a minimum balance. Dividends will always be taxed so you need to break down your profit into dividends realized and unrealized gains. PDF Excel Word TIFF email.

Only dividends and realized gains will have tax due. Reporting Betterment Tax Form. Simply head to the Documents section of your account and then click the Tax Forms.

Simplified set-up and administration makes it easy to offer your employees a better 401k. Betterment has been a member of FINRA since 1999. Betterment Taxes Summary.

Simplified set-up and administration makes it easy to offer your employees a better 401k. On Betterments broker-dealer profile available. 31 is the deadline for Betterment to.

Somewhat pricey financial advisor consultations. Tax loss harvesting TLH works by using investment losses to. 15 is the deadline for Betterment to provide Form 1099-BDIV which reports investment sales and dividends received in a taxable investment account.

Betterment keeps track for you and provides all the tax documents you need. Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust. Betterments tax strategy is just fine but rival Wealthfront is among the robo-advisors with a more sophisticated tax strategy.

Does betterment provide tax documents Saturday March 12 2022 Edit. There are three general tiers of costs but the costs change. Tax-loss harvesting has been shown to boost after.

They are not intended to provide comprehensive tax advice or financial. Betterment has multiple pricing plans from fee-free plans to 04 annual fees. This account includes a.

For example if your account has about 5000 in it the Betterment fees will be only 1 monthly at a 035 annual price. A betterment is a specific type of project performed by a government entity that improves a specific area. The other is for broking services.

Read More May 31. Its up to you to decide for yourself.

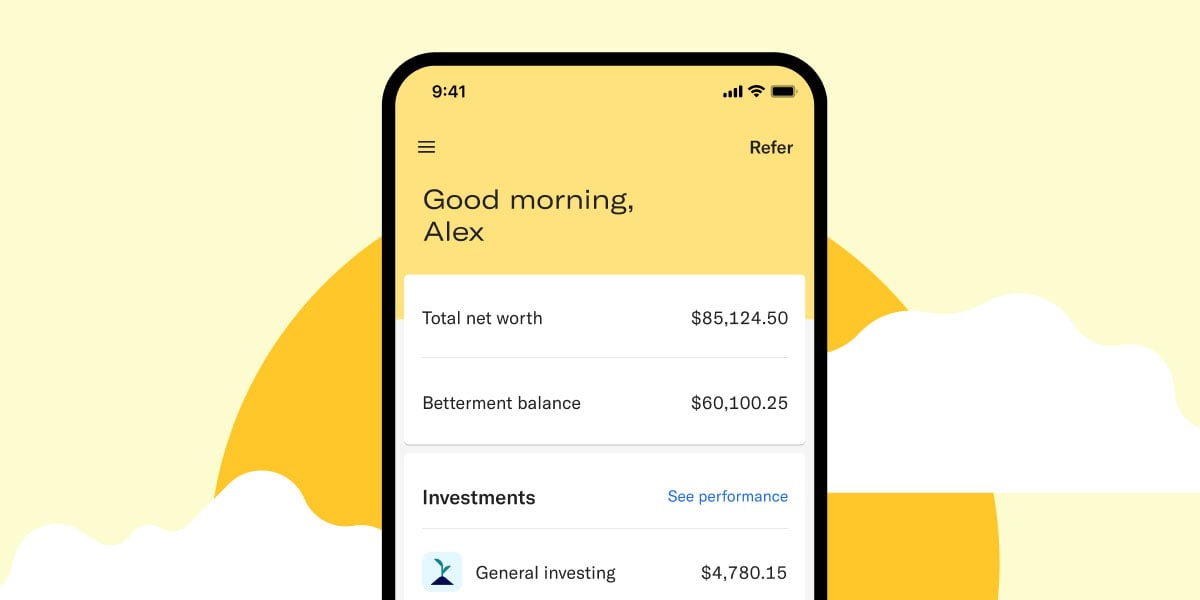

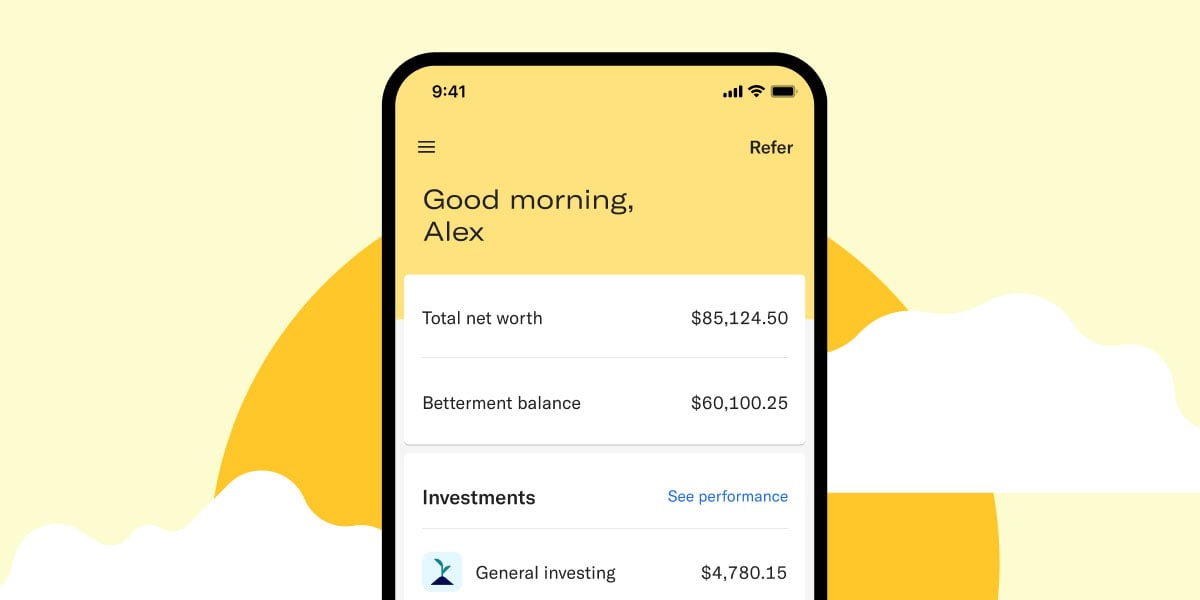

Betterment Mobile App Investing On The Go

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

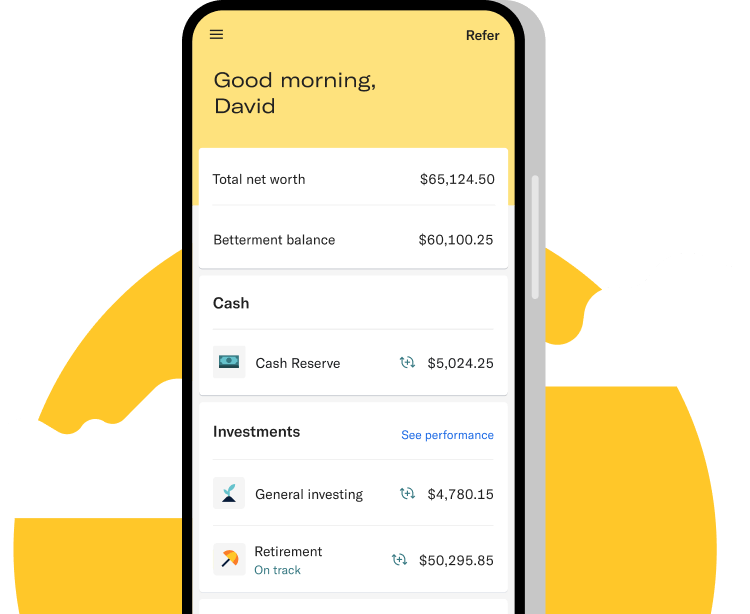

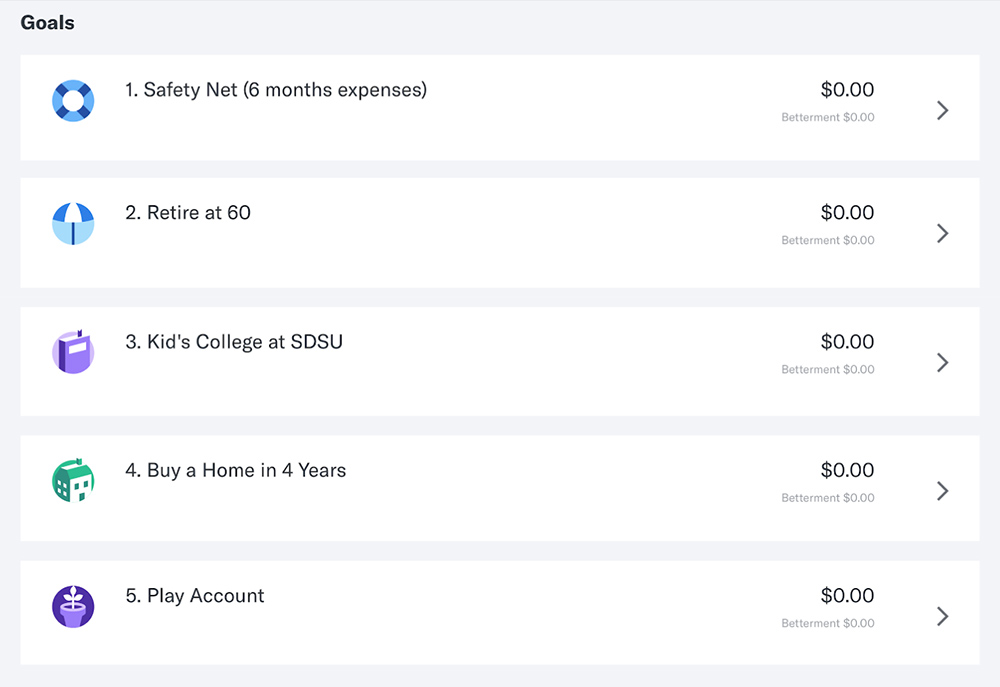

What The Ultimate Betterment User Looks Like

Betterment Review Safe Robo Advisor For Beginners

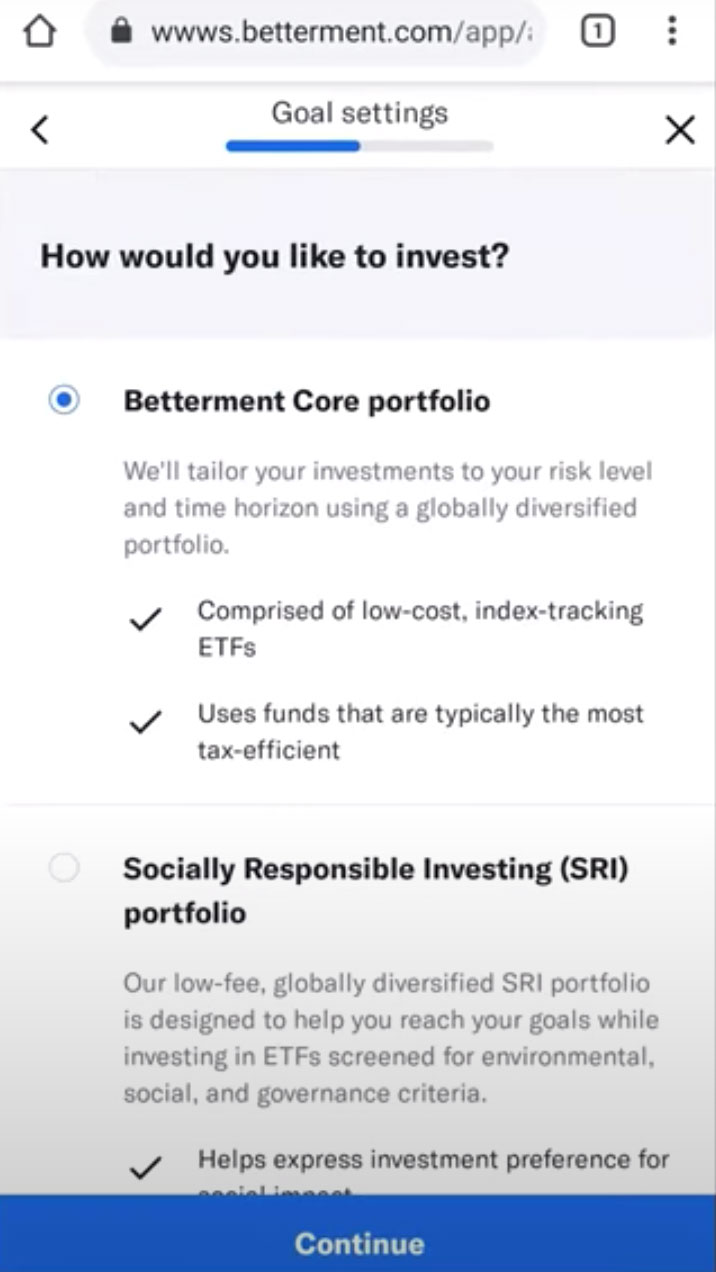

Betterment Sophisticated Online Financial Advice And Investment Management Investing Saving App Investment Tools

Tax Smart Investing With Betterment

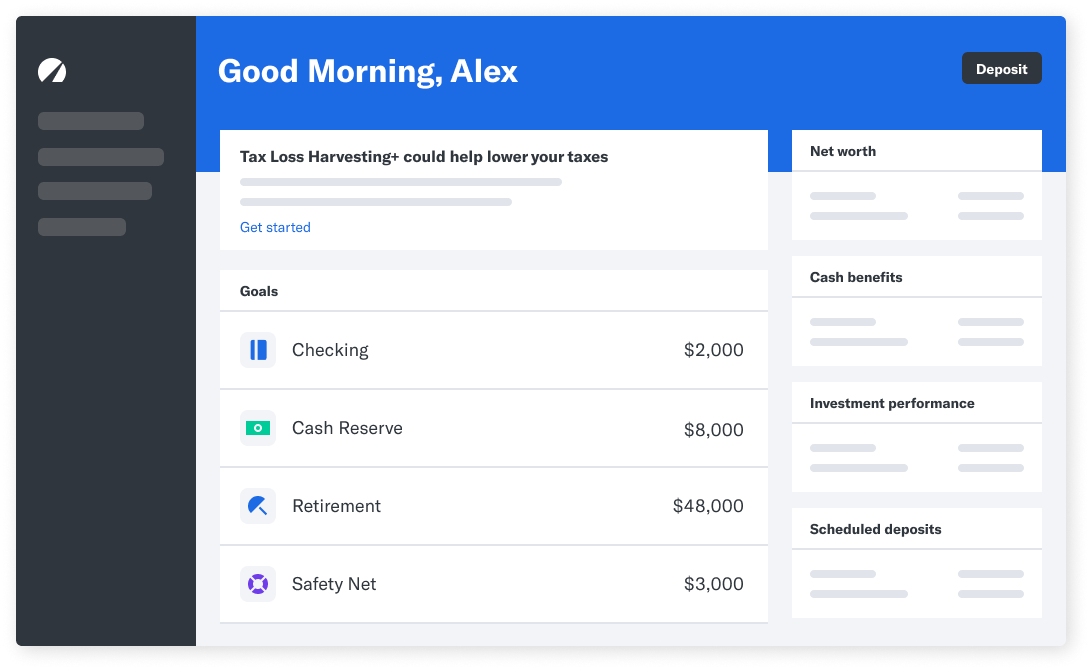

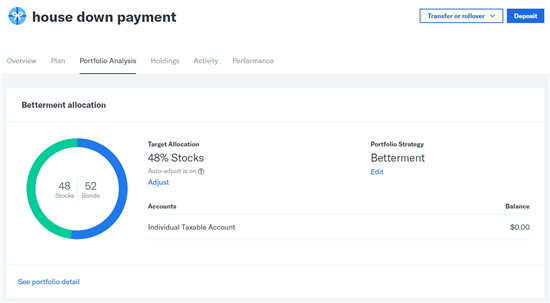

How To Set Up Your Investments Correctly At Betterment

Why Has Betterment Frozen Checking Account Applications Forbes Advisor

/wealthsimple-vs-betterment-1c84228732c642fe91a5844e25b18589.jpg)

Wealthsimple Vs Betterment Which Is Best For You

Betterment Review Automated Financial Investment Robo Advisor Investing Financial Investments Portfolio Management

Retirement Advice Retirement Calculator Investing For Retirement

How To Open An Account With Betterment

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

This Calendar Breaks Down Everything You Need To Do For Your Taxes In 2015 Tax Season Season Calendar Tax Help